Things about Property By Helander Llc

Table of ContentsNot known Incorrect Statements About Property By Helander Llc 5 Simple Techniques For Property By Helander Llc3 Simple Techniques For Property By Helander LlcProperty By Helander Llc - The FactsProperty By Helander Llc Fundamentals ExplainedAn Unbiased View of Property By Helander Llc

The advantages of spending in property are various. With well-chosen possessions, financiers can enjoy predictable capital, exceptional returns, tax obligation benefits, and diversificationand it's possible to leverage realty to build riches. Thinking of investing in property? Right here's what you require to learn about realty benefits and why actual estate is thought about a good investment.The advantages of spending in genuine estate include passive earnings, stable cash money flow, tax obligation advantages, diversification, and leverage. Genuine estate financial investment trust funds (REITs) use a method to spend in actual estate without having to have, run, or financing buildings.

Oftentimes, cash money circulation only strengthens over time as you pay for your mortgageand develop your equity. Investor can capitalize on numerous tax obligation breaks and reductions that can conserve cash at tax obligation time. Generally, you can deduct the practical expenses of owning, operating, and taking care of a home.

Excitement About Property By Helander Llc

Actual estate worths tend to increase over time, and with an excellent investment, you can turn a revenue when it's time to offer. As you pay down a residential property home mortgage, you build equityan property that's component of your net worth. And as you develop equity, you have the take advantage of to purchase even more buildings and raise cash flow and wealth also a lot more.

Because actual estate is a substantial property and one that can offer as security, funding is conveniently offered. Actual estate returns differ, depending on factors such as location, asset class, and management.

Some Known Questions About Property By Helander Llc.

This, in turn, converts into higher capital worths. For that reason, real estate often tends to preserve the purchasing power of capital by passing several of the inflationary stress on to renters and by incorporating several of the inflationary pressure in the kind of funding recognition. Home loan lending discrimination is unlawful. If you believe you have actually been differentiated against based upon race, religion, sex, marriage standing, use of public assistance, nationwide origin, handicap, or age, there are steps you can take.

Indirect property investing entails no straight possession of a building or buildings. Instead, you buy a swimming pool along with others, wherein an administration firm possesses and operates residential or commercial properties, or else owns a profile of home loans. There are a number of manner ins which owning realty can secure against inflation. First, residential property worths may increase more than the rate of inflation, leading to resources gains.

Ultimately, homes funded with a fixed-rate car loan will certainly see the relative amount of the monthly home mortgage payments drop over time-- for circumstances $1,000 a month as a set settlement will certainly become much less difficult as inflation deteriorates the buying power of that $1,000. Commonly, a key house is not thought about to be a property investment because it is made use of as one's home

The Of Property By Helander Llc

Even with the assistance of a broker, it can take a couple of weeks of job just to locate the ideal counterparty. Still, actual estate is a distinct asset course that's straightforward to recognize and can improve the risk-and-return account of an investor's profile. By itself, property uses capital, tax breaks, equity building, affordable risk-adjusted returns, and a bush against inflation.

Spending in realty can be an exceptionally satisfying and lucrative venture, yet if you're like a great deal of brand-new investors, you may be wondering WHY you need to be spending in property and what benefits it brings over various other investment possibilities. In addition to all the remarkable benefits that come along with investing in real estate, there are some disadvantages you require to think about.

Our Property By Helander Llc Statements

If you're seeking a means to get into the real estate market without needing to invest thousands of countless bucks, take a look at our residential or commercial properties. At BuyProperly, we utilize a fractional possession version that enables capitalists to start with as little as $2500. One more major advantage of realty investing is the capacity to make a high return from acquiring, restoring, and marketing (a.k.a.

Not known Facts About Property By Helander Llc

As an example, if you are billing $2,000 rent per month and you incurred dig this $1,500 in tax-deductible costs per month, you will only be paying tax on that $500 revenue per month. That's a large difference from paying tax obligations on $2,000 per month. The profit that you make on your rental for the year is thought about rental earnings and will be taxed as necessary

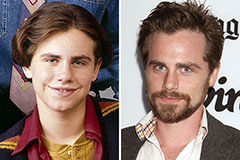

Rider Strong Then & Now!

Rider Strong Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!